We will disclose the process of resolving the refund of the deposit with the lease withdrawal fund loan

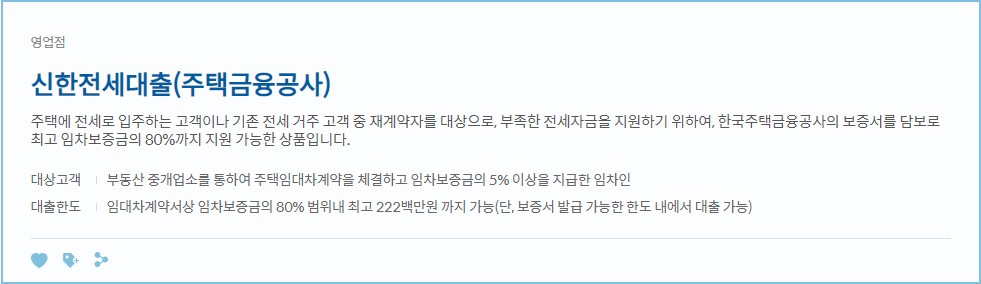

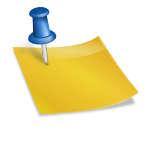

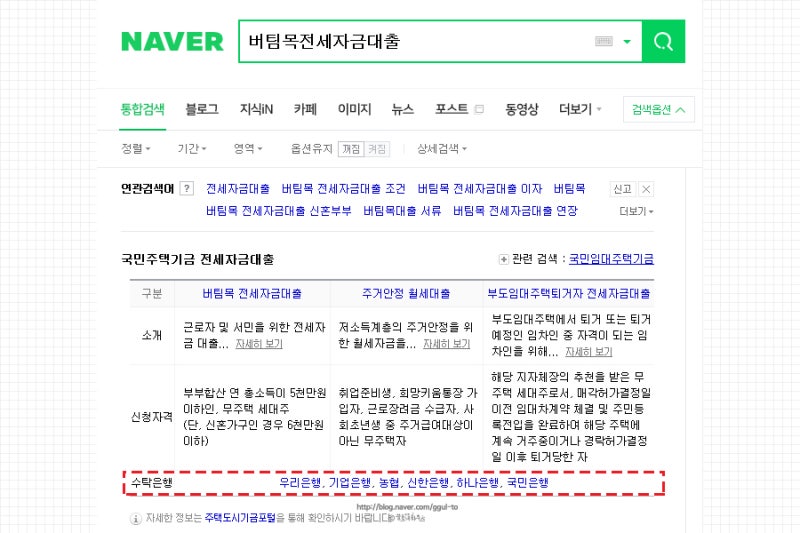

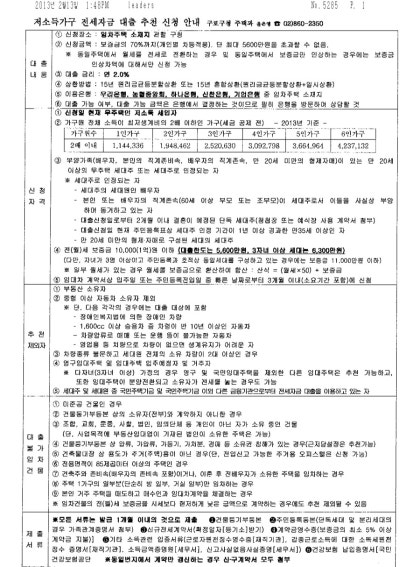

I was also cautious and worried when I signed a real estate contract because the recent economic situation, which can be solved if I make good use of the lease withdrawal loan, is not very good. I thought I had no worries or worries about real estate at all because I was the owner who bought the house, but as the tenant suddenly left, I was in a situation where I had to return the deposit quickly. Therefore, in order to get even a little help from the bank in this regard, interest rates and limits on jeonse eviction loans were investigated.I was well aware that jeonse withdrawal loans were too difficult in terms of interest rates and limits, but I was worried that the lessor had a lot to ask about, such as the market price and whether there was a reverse jeonse. So I heard that people who are new to me are worried about dsr and regulatory concerns, and I was able to solve what I wanted without difficulty by meeting a professional counselor.Fortunately, I don’t know how happy I am to be able to receive support by checking the conditions and limitations of the lease withdrawal fund loan at the right time. Recently, the economic situation is very bad, so one of the best ways to deal with these problems is to deal with them properly. Therefore, it is also a product that I applied to return the lease deposit quickly.In fact, if you have been well-examined, the conditions for the item have been changed based on two years, but the average interest rate has risen little by little compared to the previous one. So I said that many people are still watching to solve the same situation as me. Originally, I wanted to find out for myself at first, but I didn’t know where it would be good if I did it alone, and there were many things I had to find out, so I thought it would be better to get advice from experts. Certainly, I was able to get help easily and safely with consultation from an expert. 1. See if it progresses efficiently In fact, when it comes to jeonse eviction financing, you basically visit the bank to inquire whether it will proceed through a preliminary inquiry, but there are separate qualification restrictions for each financial company, so it is the most efficient way to check if I am qualified. And there are some things that you have to inquire about on your own terms before receiving them, so it is effective to keep in mind in this case.Next, it is necessary to calculate the maximum value to the extent that the existing collateral service is not affected by the real estate you own, but it depends on your income and employment, so it is best to check it out and compare financial firms carefully before getting an estimate.And even if you make a repayment in the middle, it is also attractive that the amount is lower than the existing collateral product as a commission, so the repayment cost is less burdensome, so I thought it would have been better to get an explanation through an expert. In fact, it seems that many people are applying the product smoothly with various problems in mind at a time when the economy is very bad like these days. 2. Let’s check the conditions It is also important for you to check the qualification conditions in detail, but since it was made on the condition of returning the deposit to the tenant, you can apply for the minimum lease after more than a year, and there is a regulation that you should actually live in collateral within three months of receiving the money. The limit is usually set to 60% based on government-supported products, so it would be better to consider 80% as a guarantee from mutual finance such as Saemaul Geumgo and Shinkyo Suhyup. Interest rates should be in the 2-3% range for government support, and general financial companies should expect 5-8%. The period is about the same as the lease, isn’t it? As for real estate, the standard law is changing little by little, so it is much more advantageous for those who investigate it to inquire about various information in advance and make a decision.And there is something to be careful about before receiving it, but from the bank’s point of view, it is also important for creditors to consider collateral first and move out, and these regulations vary from financial company to financial company, so please refer to this point. In fact, there are small differences depending on which company you use well, but I was able to get it with very good regulations, so I proceeded without difficulty. I got it earlier than I had imagined, so I solved it right away, but it wasn’t a burden, so I was able to spend my time comfortably. At first, I didn’t have enough information about these items, so there was a time when I suddenly checked the tenant, but I don’t know how good it was that the problem was solved cleanly. Without the help of an expert, I can imagine that I would not have been able to receive it efficiently in this case. 3. If you look closely at various products, you can definitely receive them under good regulations, and if you have to pay back the money as soon as possible, I could imagine that you can take this opportunity to receive them smoothly and use them. In order to achieve high satisfaction results, it can have a lot of impact in terms of progress, income, and credit scores, but it is also the most important way to find and decide on a financial company that suits you. If I hadn’t met the item this time, I might have been so vague that I wouldn’t even want to imagine how I was doing. Therefore, I hope that everyone who can write my article will make a wise and reasonable choice.

I was also cautious and worried when I signed a real estate contract because the recent economic situation, which can be solved if I make good use of the lease withdrawal loan, is not very good. I thought I had no worries or worries about real estate at all because I was the owner who bought the house, but as the tenant suddenly left, I was in a situation where I had to return the deposit quickly. Therefore, in order to get even a little help from the bank in this regard, interest rates and limits on jeonse eviction loans were investigated.I was well aware that jeonse withdrawal loans were too difficult in terms of interest rates and limits, but I was worried that the lessor had a lot to ask about, such as the market price and whether there was a reverse jeonse. So I heard that people who are new to me are worried about dsr and regulatory concerns, and I was able to solve what I wanted without difficulty by meeting a professional counselor.Fortunately, I don’t know how happy I am to be able to receive support by checking the conditions and limitations of the lease withdrawal fund loan at the right time. Recently, the economic situation is very bad, so one of the best ways to deal with these problems is to deal with them properly. Therefore, it is also a product that I applied to return the lease deposit quickly.In fact, if you have been well-examined, the conditions for the item have been changed based on two years, but the average interest rate has risen little by little compared to the previous one. So I said that many people are still watching to solve the same situation as me. Originally, I wanted to find out for myself at first, but I didn’t know where it would be good if I did it alone, and there were many things I had to find out, so I thought it would be better to get advice from experts. Certainly, I was able to get help easily and safely with consultation from an expert. 1. See if it progresses efficiently In fact, when it comes to jeonse eviction financing, you basically visit the bank to inquire whether it will proceed through a preliminary inquiry, but there are separate qualification restrictions for each financial company, so it is the most efficient way to check if I am qualified. And there are some things that you have to inquire about on your own terms before receiving them, so it is effective to keep in mind in this case.Next, it is necessary to calculate the maximum value to the extent that the existing collateral service is not affected by the real estate you own, but it depends on your income and employment, so it is best to check it out and compare financial firms carefully before getting an estimate.And even if you make a repayment in the middle, it is also attractive that the amount is lower than the existing collateral product as a commission, so the repayment cost is less burdensome, so I thought it would have been better to get an explanation through an expert. In fact, it seems that many people are applying the product smoothly with various problems in mind at a time when the economy is very bad like these days. 2. Let’s check the conditions It is also important for you to check the qualification conditions in detail, but since it was made on the condition of returning the deposit to the tenant, you can apply for the minimum lease after more than a year, and there is a regulation that you should actually live in collateral within three months of receiving the money. The limit is usually set to 60% based on government-supported products, so it would be better to consider 80% as a guarantee from mutual finance such as Saemaul Geumgo and Shinkyo Suhyup. Interest rates should be in the 2-3% range for government support, and general financial companies should expect 5-8%. The period is about the same as the lease, isn’t it? As for real estate, the standard law is changing little by little, so it is much more advantageous for those who investigate it to inquire about various information in advance and make a decision.And there is something to be careful about before receiving it, but from the bank’s point of view, it is also important for creditors to consider collateral first and move out, and these regulations vary from financial company to financial company, so please refer to this point. In fact, there are small differences depending on which company you use well, but I was able to get it with very good regulations, so I proceeded without difficulty. I got it earlier than I had imagined, so I solved it right away, but it wasn’t a burden, so I was able to spend my time comfortably. At first, I didn’t have enough information about these items, so there was a time when I suddenly checked the tenant, but I don’t know how good it was that the problem was solved cleanly. Without the help of an expert, I can imagine that I would not have been able to receive it efficiently in this case. 3. If you look closely at various products, you can definitely receive them under good regulations, and if you have to pay back the money as soon as possible, I could imagine that you can take this opportunity to receive them smoothly and use them. In order to achieve high satisfaction results, it can have a lot of impact in terms of progress, income, and credit scores, but it is also the most important way to find and decide on a financial company that suits you. If I hadn’t met the item this time, I might have been so vague that I wouldn’t even want to imagine how I was doing. Therefore, I hope that everyone who can write my article will make a wise and reasonable choice.

I was also cautious and worried when I signed a real estate contract because the recent economic situation, which can be solved if I make good use of the lease withdrawal loan, is not very good. I thought I had no worries or worries about real estate at all because I was the owner who bought the house, but as the tenant suddenly left, I was in a situation where I had to return the deposit quickly. Therefore, in order to get even a little help from the bank in this regard, interest rates and limits on jeonse eviction loans were investigated.I was well aware that jeonse withdrawal loans were too difficult in terms of interest rates and limits, but I was worried that the lessor had a lot to ask about, such as the market price and whether there was a reverse jeonse. So I heard that people who are new to me are worried about dsr and regulatory concerns, and I was able to solve what I wanted without difficulty by meeting a professional counselor.Fortunately, I don’t know how happy I am to be able to receive support by checking the conditions and limitations of the lease withdrawal fund loan at the right time. Recently, the economic situation is very bad, so one of the best ways to deal with these problems is to deal with them properly. Therefore, it is also a product that I applied to return the lease deposit quickly.In fact, if you have been well-examined, the conditions for the item have been changed based on two years, but the average interest rate has risen little by little compared to the previous one. So I said that many people are still watching to solve the same situation as me. Originally, I wanted to find out for myself at first, but I didn’t know where it would be good if I did it alone, and there were many things I had to find out, so I thought it would be better to get advice from experts. Certainly, I was able to get help easily and safely with consultation from an expert. 1. See if it progresses efficiently In fact, when it comes to jeonse eviction financing, you basically visit the bank to inquire whether it will proceed through a preliminary inquiry, but there are separate qualification restrictions for each financial company, so it is the most efficient way to check if I am qualified. And there are some things that you have to inquire about on your own terms before receiving them, so it is effective to keep in mind in this case.Next, it is necessary to calculate the maximum value to the extent that the existing collateral service is not affected by the real estate you own, but it depends on your income and employment, so it is best to check it out and compare financial firms carefully before getting an estimate.And even if you make a repayment in the middle, it is also attractive that the amount is lower than the existing collateral product as a commission, so the repayment cost is less burdensome, so I thought it would have been better to get an explanation through an expert. In fact, it seems that many people are applying the product smoothly with various problems in mind at a time when the economy is very bad like these days. 2. Let’s check the conditions It is also important for you to check the qualification conditions in detail, but since it was made on the condition of returning the deposit to the tenant, you can apply for the minimum lease after more than a year, and there is a regulation that you should actually live in collateral within three months of receiving the money. The limit is usually set to 60% based on government-supported products, so it would be better to consider 80% as a guarantee from mutual finance such as Saemaul Geumgo and Shinkyo Suhyup. Interest rates should be in the 2-3% range for government support, and general financial companies should expect 5-8%. The period is about the same as the lease, isn’t it? As for real estate, the standard law is changing little by little, so it is much more advantageous for those who investigate it to inquire about various information in advance and make a decision.And there is something to be careful about before receiving it, but from the bank’s point of view, it is also important for creditors to consider collateral first and move out, and these regulations vary from financial company to financial company, so please refer to this point. In fact, there are small differences depending on which company you use well, but I was able to get it with very good regulations, so I proceeded without difficulty. I got it earlier than I had imagined, so I solved it right away, but it wasn’t a burden, so I was able to spend my time comfortably. At first, I didn’t have enough information about these items, so there was a time when I suddenly checked the tenant, but I don’t know how good it was that the problem was solved cleanly. Without the help of an expert, I can imagine that I would not have been able to receive it efficiently in this case. 3. If you look closely at various products, you can definitely receive them under good regulations, and if you have to pay back the money as soon as possible, I could imagine that you can take this opportunity to receive them smoothly and use them. In order to achieve high satisfaction results, it can have a lot of impact in terms of progress, income, and credit scores, but it is also the most important way to find and decide on a financial company that suits you. If I hadn’t met the item this time, I might have been so vague that I wouldn’t even want to imagine how I was doing. Therefore, I hope that everyone who can write my article will make a wise and reasonable choice.

I was also cautious and worried when I signed a real estate contract because the recent economic situation, which can be solved if I make good use of the lease withdrawal loan, is not very good. I thought I had no worries or worries about real estate at all because I was the owner who bought the house, but as the tenant suddenly left, I was in a situation where I had to return the deposit quickly. Therefore, in order to get even a little help from the bank in this regard, interest rates and limits on jeonse eviction loans were investigated.I was well aware that jeonse withdrawal loans were too difficult in terms of interest rates and limits, but I was worried that the lessor had a lot to ask about, such as the market price and whether there was a reverse jeonse. So I heard that people who are new to me are worried about dsr and regulatory concerns, and I was able to solve what I wanted without difficulty by meeting a professional counselor.Fortunately, I don’t know how happy I am to be able to receive support by checking the conditions and limitations of the lease withdrawal fund loan at the right time. Recently, the economic situation is very bad, so one of the best ways to deal with these problems is to deal with them properly. Therefore, it is also a product that I applied to return the lease deposit quickly.In fact, if you have been well-examined, the conditions for the item have been changed based on two years, but the average interest rate has risen little by little compared to the previous one. So I said that many people are still watching to solve the same situation as me. Originally, I wanted to find out for myself at first, but I didn’t know where it would be good if I did it alone, and there were many things I had to find out, so I thought it would be better to get advice from experts. Certainly, I was able to get help easily and safely with consultation from an expert. 1. See if it progresses efficiently In fact, when it comes to jeonse eviction financing, you basically visit the bank to inquire whether it will proceed through a preliminary inquiry, but there are separate qualification restrictions for each financial company, so it is the most efficient way to check if I am qualified. And there are some things that you have to inquire about on your own terms before receiving them, so it is effective to keep in mind in this case.Next, it is necessary to calculate the maximum value to the extent that the existing collateral service is not affected by the real estate you own, but it depends on your income and employment, so it is best to check it out and compare financial firms carefully before getting an estimate.And even if you make a repayment in the middle, it is also attractive that the amount is lower than the existing collateral product as a commission, so the repayment cost is less burdensome, so I thought it would have been better to get an explanation through an expert. In fact, it seems that many people are applying the product smoothly with various problems in mind at a time when the economy is very bad like these days. 2. Let’s check the conditions It is also important for you to check the qualification conditions in detail, but since it was made on the condition of returning the deposit to the tenant, you can apply for the minimum lease after more than a year, and there is a regulation that you should actually live in collateral within three months of receiving the money. The limit is usually set to 60% based on government-supported products, so it would be better to consider 80% as a guarantee from mutual finance such as Saemaul Geumgo and Shinkyo Suhyup. Interest rates should be in the 2-3% range for government support, and general financial companies should expect 5-8%. The period is about the same as the lease, isn’t it? As for real estate, the standard law is changing little by little, so it is much more advantageous for those who investigate it to inquire about various information in advance and make a decision.And there is something to be careful about before receiving it, but from the bank’s point of view, it is also important for creditors to consider collateral first and move out, and these regulations vary from financial company to financial company, so please refer to this point. In fact, there are small differences depending on which company you use well, but I was able to get it with very good regulations, so I proceeded without difficulty. I got it earlier than I had imagined, so I solved it right away, but it wasn’t a burden, so I was able to spend my time comfortably. At first, I didn’t have enough information about these items, so there was a time when I suddenly checked the tenant, but I don’t know how good it was that the problem was solved cleanly. Without the help of an expert, I can imagine that I would not have been able to receive it efficiently in this case. 3. If you look closely at various products, you can definitely receive them under good regulations, and if you have to pay back the money as soon as possible, I could imagine that you can take this opportunity to receive them smoothly and use them. In order to achieve high satisfaction results, it can have a lot of impact in terms of progress, income, and credit scores, but it is also the most important way to find and decide on a financial company that suits you. If I hadn’t met the item this time, I might have been so vague that I wouldn’t even want to imagine how I was doing. Therefore, I hope that everyone who can write my article will make a wise and reasonable choice.

I was also cautious and worried when I signed a real estate contract because the recent economic situation, which can be solved if I make good use of the lease withdrawal loan, is not very good. I thought I had no worries or worries about real estate at all because I was the owner who bought the house, but as the tenant suddenly left, I was in a situation where I had to return the deposit quickly. Therefore, in order to get even a little help from the bank in this regard, interest rates and limits on jeonse eviction loans were investigated.I was well aware that jeonse withdrawal loans were too difficult in terms of interest rates and limits, but I was worried that the lessor had a lot to ask about, such as the market price and whether there was a reverse jeonse. So I heard that people who are new to me are worried about dsr and regulatory concerns, and I was able to solve what I wanted without difficulty by meeting a professional counselor.Fortunately, I don’t know how happy I am to be able to receive support by checking the conditions and limitations of the lease withdrawal fund loan at the right time. Recently, the economic situation is very bad, so one of the best ways to deal with these problems is to deal with them properly. Therefore, it is also a product that I applied to return the lease deposit quickly.In fact, if you have been well-examined, the conditions for the item have been changed based on two years, but the average interest rate has risen little by little compared to the previous one. So I said that many people are still watching to solve the same situation as me. Originally, I wanted to find out for myself at first, but I didn’t know where it would be good if I did it alone, and there were many things I had to find out, so I thought it would be better to get advice from experts. Certainly, I was able to get help easily and safely with consultation from an expert. 1. See if it progresses efficiently In fact, when it comes to jeonse eviction financing, you basically visit the bank to inquire whether it will proceed through a preliminary inquiry, but there are separate qualification restrictions for each financial company, so it is the most efficient way to check if I am qualified. And there are some things that you have to inquire about on your own terms before receiving them, so it is effective to keep in mind in this case.Next, it is necessary to calculate the maximum value to the extent that the existing collateral service is not affected by the real estate you own, but it depends on your income and employment, so it is best to check it out and compare financial firms carefully before getting an estimate.And even if you make a repayment in the middle, it is also attractive that the amount is lower than the existing collateral product as a commission, so the repayment cost is less burdensome, so I thought it would have been better to get an explanation through an expert. In fact, it seems that many people are applying the product smoothly with various problems in mind at a time when the economy is very bad like these days. 2. Let’s check the conditions It is also important for you to check the qualification conditions in detail, but since it was made on the condition of returning the deposit to the tenant, you can apply for the minimum lease after more than a year, and there is a regulation that you should actually live in collateral within three months of receiving the money. The limit is usually set to 60% based on government-supported products, so it would be better to consider 80% as a guarantee from mutual finance such as Saemaul Geumgo and Shinkyo Suhyup. Interest rates should be in the 2-3% range for government support, and general financial companies should expect 5-8%. The period is about the same as the lease, isn’t it? As for real estate, the standard law is changing little by little, so it is much more advantageous for those who investigate it to inquire about various information in advance and make a decision.And there is something to be careful about before receiving it, but from the bank’s point of view, it is also important for creditors to consider collateral first and move out, and these regulations vary from financial company to financial company, so please refer to this point. In fact, there are small differences depending on which company you use well, but I was able to get it with very good regulations, so I proceeded without difficulty. I got it earlier than I had imagined, so I solved it right away, but it wasn’t a burden, so I was able to spend my time comfortably. At first, I didn’t have enough information about these items, so there was a time when I suddenly checked the tenant, but I don’t know how good it was that the problem was solved cleanly. Without the help of an expert, I can imagine that I would not have been able to receive it efficiently in this case. 3. If you look closely at various products, you can definitely receive them under good regulations, and if you have to pay back the money as soon as possible, I could imagine that you can take this opportunity to receive them smoothly and use them. In order to achieve high satisfaction results, it can have a lot of impact in terms of progress, income, and credit scores, but it is also the most important way to find and decide on a financial company that suits you. If I hadn’t met the item this time, I might have been so vague that I wouldn’t even want to imagine how I was doing. Therefore, I hope that everyone who can write my article will make a wise and reasonable choice.

Previous image Next image

Previous image Next image

Previous image Next image